Exclusive Exposé: The Wild West Of Landlord Technology

Property Tech Is Ruining Your Community And You Don't Even Know It

Joseph Smooke, Dyan Ruiz | 09/29/2020

Photo Credit: All Illustrations by Frederick Noland

Special thanks to Anti-Eviction Mapping Project co-founder and postdoctoral researcher at NYU's AI Now Institute, Erin McElroy; UC Berkeley professor, Desiree Fields; and MIT PhD candidate, Wonyoung So, for their contributions to this article.

Your landlord's getting anxious-

starting to think that you've been in your place too long.

You've only lived there for two years?

You're just starting to become secure in your job and get involved in your community?

Sorry, two years is too long. Far too much time for someone to stay in one place.

You just lost your job because of the Coronavirus? So sorry to hear that. Your landlord still wants you out.

Your landlord is cashing in on the latest real estate scam that's inflating the most dangerous housing bubble yet. The industry calls it "Property Technology". Insiders refer to it as "PropTech". [people. power. media] and the Anti-Eviction Mapping Project have been researching this voracious beast devouring housing units all over the world. We've dubbed it a title that better describes the impact of this disruptive tech: "Landlord Tech". In this [people. power. media] in-depth exclusive, we dig deep to expose just how insidious, pervasive and largely unregulated Landlord Technology is.

Photo: Joseph Smooke

Have you seen "security" cameras installed at your front door? Are there lock boxes attached to the entrance gate to your building? Does the unit down the hall constantly have new people? Is the unit next door vacant despite news about a housing shortage? Did you recently get turned down for a home loan or an apartment you applied for because you have bad credit- even though your records show that your credit is flawless? Is your landlord eager to evict you for nonpayment even though you lost your job due to COVID-19?

Given its expansive impacts, [people. power. media] is excited to be working on this issue with the Anti-Eviction Mapping Project that developed a website that maps where these technologies are deployed across the US. Since there aren't any reliable registries or ways to track where these platforms are operating, we need to hear from you! The website has a survey you can fill out that will help us to identify what type of Landlord Tech is being deployed and where.

Anti-Eviction Mapping Project's Landlord Tech Website

Is Landlord Tech wreaking havoc on your apartment or home? Not sure? Read on, then let us know! This is the first major feature on property technology- anywhere- revealing everything you need to know about this emerging industry and how it affects tenants and homeowners, including:

An overview of how and why they make so much money;

The major ways Landlord Tech is used, such as tenant screening and selection, property management, neighborhood & home surveillance and smart homes, and membership housing;

The big data players and who's getting rich from Landlord Tech including the platforms, corporations, private equity, venture capital, real estate investment trusts (REITs), and landlords & developers; and finally

Solutions.

So, what’s going on?

The foreclosure crisis that started in 2008 exposed destructive new ways that profit is extracted from housing, and clearly showed how greed puts people's livelihoods at risk. Unfortunately, the abuses and profiteering from housing didn't end after the foreclosure crisis and the passage of the Dodd-Frank Act. Instead, we find ourselves today in an even scarier evolutionary stage of this extractive greed. Our society is now the Wild West of Landlord Tech, as pioneering firms seek even greater profits and in the process are making your housing more expensive and unstable. The economic disaster from the COVID-19 pandemic has further primed the housing industry for takeover by these companies.

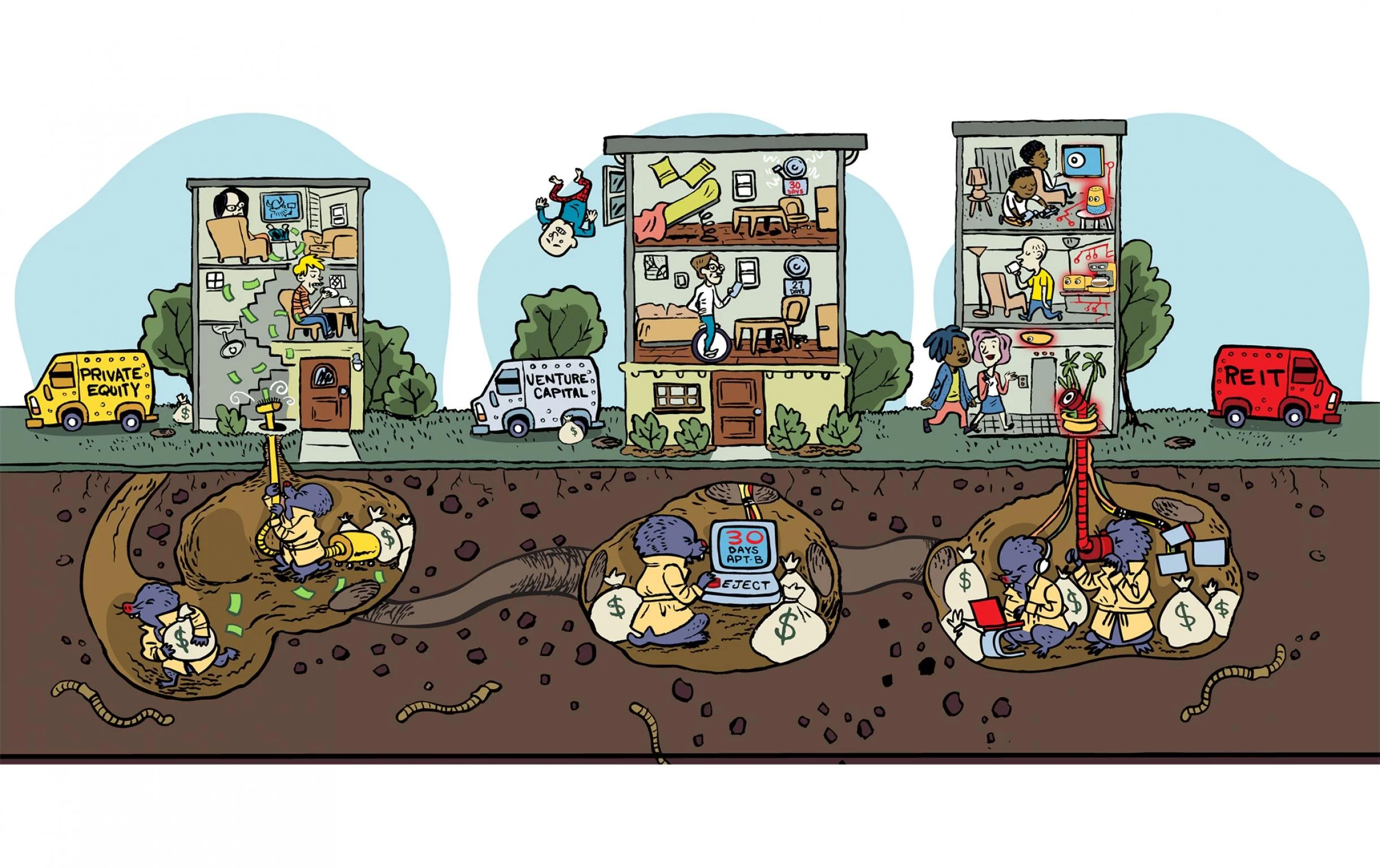

Similar to the mortgage scam that caused so many people to lose their homes a decade ago, the rise of Landlord Tech affects millions of people around the world with rampant evictions, foreclosures, and rents that are rising much faster than wages. The players that fund and manage Landlord Tech operate in businesses and networks largely unseen and unregulated, as if they had a series of underground tunnels for moving their cash from housing units to their getaway vehicles. They inflict their damage on tenants and homeowners with impunity.

In this article, we sketch an overview of the network of services these platforms provide and the impacts these services have on tenants, homeowners, and the real estate industry. This is a dynamic, expanding, extremely well-capitalized new field (increasing more than nine-fold in just six years to roughly $27 billion in 2019- see the chart to the left) operating in the immensely profitable overlap between real estate and tech.

Two of the most valuable commodities that companies seek to control in today's economy are data and housing. Landlord tech companies provide housing-related services to monopolize housing-related data. Or, they use data in novel ways to commandeer housing units. Approaching the industry from either direction- from the property or the data sides, Landlord Tech platforms control both data and housing for their own profit at the expense of your privacy and stability.

Rather than as a home or place of shelter, housing is increasingly treated as a financial asset. This, and the rise of data as a form of capital are dynamics that reinforce each other and they in many cases overlap. Platforms like entera.ai facilitate this overlap by leveraging artificial intelligence to match investors with properties.

Since these companies make money from housing, using the word "Landlord" to describe this sector seems pretty clear, but you may be wondering why these companies are categorized as "Tech". To understand why this is tech, let's first look at a (non-housing) company we all know well. Tech giant, Google provides a whole range of services including e-mail and internet searching. While e-mail and web searching simply seem like basic services that you access every day from your computer, Google profits when you use those services by capitalizing on the data they capture from your e-mails and your internet searches. In order to capture the most data from you, they make sure that as many people as possible use only Google for every e-mail and for every one of their internet searches. This monopolization of data gives Google an extraordinary competitive advantage and access to trillions of dollars in revenues- all made possible by providing you with a suite of "free" services that you like so much that you use them many times a day.

Landlord Tech companies operate in a similar way. On the surface, they're "disrupting" traditional real estate services to make everything from buying and selling property to installing security systems to collecting rent, easier and better. But the real disruption these businesses cause is to capture, utilize and monopolize data- using algorithms to collect and analyze all this data to their profitable advantage. They select to operate in particular cities, and they price their services strategically in ways that the older generation of real estate services is unable to do.

Since these new services are data dependent, these companies attract the same venture capital investors as other tech "disruptors" that you're probably more familiar with- such as Uber, which uses technology to disrupt the taxi industry, and Amazon which uses technology to disrupt retail.

The disruption that tech businesses like Uber and Amazon create is not just to modernize industries through the deployment of innovative technologies. They also disrupt people's lives through promoting a gig economy in place of stable work, a lack of worker benefits, environmental damage, destruction of small businesses, and so many other negative impacts including the gentrifying and displacing effects caused by their corporate campuses and offices. With Landlord Tech, the meaning of "disruption" shares all of these same impacts to the livelihoods of people and communities, and it adds yet another sinister dimension which is to directly threaten your ability to remain in your home.

While a deep dive into Landlord Tech reveals alarming surveillance and data privacy concerns, it is also vital to understand how digital real estate tools are facilitating capital accumulation in ways that undermine housing stability and affordability. Housing instability and high costs have plagued tenants and home owners alike for decades. But these are put in high gear through real estate tools under the mantras of “transparency”, such as digital access to property listings, and “easing frictions", making transactions faster and involving less people. These tools must be recognized as promises of profitability to landlords—and as threats to tenants and homeowners.

Tenant Screening and Selection

Landlords and management companies contract with services that provide background and credit checks for selecting new tenants, that is tenant screening and selection. They also use the same services for selecting roommates and for managing shared living. Providing these services are Landlord Tech platforms such as Badi, Nesterly, Zumper, Instarent, Naborly and HubHaus.

Decisions about who has good credit, who has the right background, who has enough income and the right source of income, and who would make a good fit as a roommate are now based on automated algorithms. These programs run based on the programmers' cultural and economic biases and preconceptions- and are often tailored to what their customers (i.e. landlords) demand. As Professor Ruha Benjamin writes in her book Race After Technology, "there is a slippery slope between effective marketing and efficient racism. The same sort of algorithmic filtering that ushers more ethnically tailored representations into my (social media) feed can also redirect real estate ads away from people 'like me'." Benjamin, who is African-American, also quotes from a report that says "the simplest explanation for biased algorithms is that the humans who create them have their own deeply entrenched biases. That means that despite perceptions that algorithms are somehow neutral and uniquely objective, they can often reproduce and amplify existing prejudices." Computer programs are not neutral and objective because they incorporate the biases or programmers and the society they live in.

You may fill out a simple online form that only asks for your name and zip code, and you think that the information being requested is so basic that the requester can't possibly use that information for anything nefarious. What you don't realize is that the short form you just filled out is evaluated by an algorithm that uses this very basic data to determine your eligibility for that loan or apartment. The algorithm associates your name with assumptions about your race and ethnicity. Then it associates your zip code with your probable economic standing and potential for upward mobility. Since these platforms operate in an unregulated environment, there is no way to know whether the assumptions and selections they make are in violation of Fair Housing (Civil Rights) law.

Housing companies “can use predictive software programs to ascertain information that they cannot request directly", says Benjamin in Race After Technology. Benjamin spoke with a representative of tech company, Diversity, Inc, that revealed how Diversity uses names and zip codes to ascertain race, ethnicity and economic status with a high degree of accuracy. Benjamin notes, "In a country as segregated as the United States, geography is a reliable proxy for race."

As long as technology uses geography as a determiner of who gets access to housing, it becomes apparent that these technology platforms are not neutral and are actually deepening segregation and racism. "From retail to real estate" says Lauren Kirchner in "When big data becomes bad data", "the use of data mining, scoring and predictive software… is proliferating.” And “when software makes decisions based on data, like a person's zip code, it can reflect, or even amplify, the results of historical or institutional discrimination," she continues.

There is evidence that the background information these companies gather about applicants is often incorrect and can lead to devastating personal consequences. Although we commonly think of data and technology as being a neutral medium for decision making, this is a dangerous assumption. We have to remember that the technology used to make decisions about whose application will be approved for an apartment or a loan is built on codes written by people. The decisions those people make are generally based on a business model of profitability, so writing code that discriminates based on race and assumptions about economic mobility signals that Landlord Tech is in effect the latest form of redlining and racist segregation.

Property Management

Landlords and management companies outsource and automate many of their daily and monthly routine functions in an effort to cut costs and increase revenues. These outsourced tasks include rent collection, responding to maintenance requests, and serving late or eviction notices to tenants. Some of the Landlord Tech platforms that provide these routine property management services are Rhino, Jetty, HelloRented, MainStreet, Domuso, Till, Tokeet and Doorstead.

Seeing an opportunity in this time of economic crisis with millions of people out of work, a new Landlord Tech company is hiring gig workers to evict tenants! A new company called Civvl hires people as contract workers to serve eviction papers to tenants and homeowners who have lost their jobs and are no longer able to make their rent or mortgage payments. Linking property management to the gig economy is a new phase of predatory business practice that is taking shape during this deepening COVID-19 economic crisis.

Of course, as with all tech businesses, a service is provided, but often the primary objective is to collect data. The data collected by this sector of businesses is extremely valuable:

How much rent each tenant is paying;

What day of the month do they typically pay;

How do they pay (cashier's check, check, cash);

What are the rates of turnover for particular units and buildings in certain neighborhoods; and

What are the operating costs for different buildings and in different regions.

The more data a Landlord Tech firm collects, the better positioned it is to offer services to landlords that are increasingly automated and competitively priced, therefore increasing the likelihood that it will be competitive for services contracts.

Some examples of the downside for the tenant are that:

Repairs are often not done;

Evictions and other notices are automated rather than being responsive to real life circumstances; and

Applications for rentals can be denied based on various criteria including the person's name and the zip code they're moving from.

In addition to these types of property management services, there is a whole group of companies within the property management sector that act as third parties for managing rental payments, security deposits and renters insurance. A tenant may sign up for a rental payment service because their income isn't constant from month to month. The service pays the rent for them to the landlord, and sometimes will collect the rent from the tenant in installments throughout each month. If the tenant can't make timely payments to the service, they have to pay late fees. A Landlord Tech platform like Doorstead both collects the rent and handles evictions with "data and tech at every step" ensuring three to nine percent "higher profits for owners." An additional peril for tenants arises when the platform itself defaults on its obligation to follow through on its obligation to pay the landlord, like what happened recently with HubHaus.

The security deposit services work more like an insurance policy. Rather than coming up with a large sum when you move in, you pay the Landlord Tech platform monthly. Not only are these companies collecting financial and personal data, but they're also a creditor in addition to your landlord. There are also many unknowns about how these companies qualify applicants for their services. Is there discrimination? And there are questions of how they pursue collections and charge fees and interest. Is there damage to the tenants' credit or can they lose housing?

In this unprecented economic disaster brought on by the COVID-19 pandemic, everyone is affected financially or otherwise. Many people may find that they don't have any one person to appeal to if they can't pay their rent, but instead have to navigate a labyrinth of landlord proxies because of Landlord Tech. Another example of how Landlord Tech has responded to the CoVID-19 crisis is Landlord Tech platform, Naborly, that provides tenant screening services. Near the start of the pandemic's economic crisis, they asked that landlords report to them which tenants were unable to pay their rent. These are tenants who had lost their jobs due to COVID-19 who were being red tagged in Naborly's database as being risky tenants.

Neighborhood and Home Surveillance, and Smart Homes

Homeowners, landlords, and property management companies have increased their monitoring of activities in and around their buildings using sophisticated high definition cameras and audio recording devices. They make look the same as the old standard definition Closed Circuit TV (CCTV) cameras, which have been installed in millions of buildings for decades. But this is next level. The high definition imaging and ability to share the images through online networks, and the capability to implement facial recognition and biometric data collection, and even license plate readers make these surveillance systems completely different from the old ones they're replacing. Big Brother is a now highly integrated, hi-tech and serves your landlord.

What's new is the ability of these new systems to acquire and collect data, then share that data, including to government agencies and big data firms to create a network of public and private surveillance that determines who has access to housing, and alerts law enforcement to people and activity deemed as suspicious. Some of the Landlord Tech companies that manage these new hardware devices and the data collected by them are Stonelock, PooPrints, GateGuard, Flock Safety, Carson, and Amazon Ring.

The surveillance doesn't stop at the entry gate- or in the hallways or other common areas. Surveillance tech now follows you all the way inside your own home. These are devices that set your thermostat, help you pick out a shirt, or act as your virtual assistant in so many other ways. Some of these Landlord Tech platforms include SmartRent, Dish, Alexa, Google Assistant, and Bumblebee Spaces.

The service that you're getting from these systems may seem simple enough. The key fob your landlord gave you to replace that fussy, ancient, manual metal key probably seems like a convenient, modern upgrade. What seems like a convenience, however, isn't just a hands-free way to enter your building or unit. It's a data collecting and transmitting device that your landlord uses to track who's coming and going, how many visitors and for how long, and other data. This is often coupled with high definition security cameras that are bundled with facial and voice recognition software.

That app service you used to furnish your apartment is also Landlord Tech. One of the conveniences that comes along with the furnishings is a voice enabled virtual assistant. The tech company that furnished your home is now tracking how you use the furnishings and appliances they installed for you so they can learn how people's tastes and habits change. They may also use that data to try to assign fault to you, the tenant, when it comes time for the management company to make repairs to your unit. So maybe think twice you buy that next hi-tech device or sign up for that revolutionary app, and look at using your fingers, arms and legs as not such an inconvenience.

Membership Housing

Tech platforms are increasingly owning or master leasing units and charging people a membership fee to be able to stay at their locations. These are residential membership services targeted to people who don't want to be tied down to a long term lease. The tech platform isn't technically operating a "short term rental" because the platform rents or master leases the units for more than 30 days, or they sometimes own the units or entire buildings. This allows the platform to operate unregulated even in areas that have laws restricting short term rentals, such as Airbnb. Some of the Landlord Tech platforms that operate membership housing are Bedly and Outpost, PodShare, Starcity and PadSplit.

These may seem like amazing services for people who are mobile especially if they need to linger somewhere for longer than a typical stay in a tourist hotel, however, who gets selected for membership? Are there discrimination issues? Was someone evicted from their apartment so one of these lucrative businesses could move in?

Some cities and states have laws that protect tenants as soon as someone pays rent and stays at that place for more than 30 days. What happens when a "member" stays for more than 30 days and the platform asks that member to move on if they have other members wanting to use that unit? Does the company kick that person out so other members can take their unit? The member might move out if the company tells them to, and this might jeopardize their ability to access work. Often landlords will evict real, long term tenants and master lease to one of these membership housing platforms, because the membership platform will generally pay more than a long term tenant will pay.

Non-residential leases

One of the oldest forms of Landlord Tech is the "short term rental" pioneered by companies like Airbnb. When they started, these platforms provided a way for people to rent out an extra room in their apartment or home to get some extra income and provide a traveler with an inexpensive place to stay. But increasingly, these platforms have displaced tenants from entire apartments, condos and homes, transforming them into de facto hotel suites where executives or tourists replace long term tenants. Despite the fact that many cities have passed laws to regulate short term rentals, there is a dizzying number of new businesses expanding into this sector including Bungalow, WhyHotel, Vornado Realty Trust, Sonder, StayAlfred, Lyric, The Guild, Vacasa, AllTheRooms, Ollie, PeerSpace, Globe Living, Key Housing, Roost, AKA, Anyplace and Blueground. They all have different niches and target clientele, and their platforms are flexible enough to comply with and exploit loopholes where there are regulations and restrictions on short term rentals.

It's easy to do the math to figure out the incentive for a landlord to rent their units out for short rather than long durations. So let's do some math! Someone who pays $2,000 a month for their apartment might be willing to pay $150 a night for a hotel room when they go on vacation. That family that pays $150 a night for the hotel might only do that for 3 nights at a time- for a long weekend getaway. Of course if that hotel room is occupied 30 nights out of a month by ten different families each seeking a 3-night getaway, that hotel room is bringing in $4,500 for the month instead of the $2,000 that the apartment's landlord is pulling in.

That's a sizable difference! A private equity or venture capital firm would look at this difference in revenue and demand the higher number, not the lower one. If there's a way to operate that unit more like a hotel than an apartment, it could cash flow like a hotel room. Not only does this provide an incentive for landlords to operate long term rental units for shorter and shorter term users, but it also creates an incentive for the landlord to evict long term tenants so shorter term occupants can replace them.

The trend in Landlord Tech is to use data to manage units so that each apartment or home or condo is used for the shortest amount of time possible, so the pricing can be adjusted for each new short-duration occupant on a "real time" basis. The more turnover, the more rapidly pricing can be adjusted. Let's say the family that's willing to pay $150 a night for a hotel stay can be replaced by a worker who's willing to pay $250 a day for a safe, socially distanced place to work during this COVID crisis. The landlord will know that this type of use is more lucrative and will turn the unit over and start marketing it differently based on what their data tells them.Globe may just be coordinating this service in spare living rooms today, but the potential for that model to transform into entire units like what happened with AirBnb is not far-fetched.

What does this mean for someone who just needs a place to live? Let's continue with the math exercise. When a landlord looks at various strategies for making more money, they might either evict the barista who's paying $1,500 a month, then select a tech engineer to be the new tenant who can pay $3,000 a month; or they might evict the teacher who's paying $1,750 a month so they can contract with a Landlord Tech firm for short term rentals, or corporate rentals that can pay $4,000 a month. That second option increases revenue and offloads expenses onto the tech firm that manages the constant turnover. Of course it also means that regular tenants who just need a place to live will get evicted so the landlord can make more money!

As long as this second option is available, the teacher or the barista has little hope of being able to stay in their home. The potential profit from speculating on shorter duration uses is too great, and as long as venture capital and private equity are involved in managing real estate and investing in Landlord Tech, their business model will always be to increase revenues and cut expenses. Their speculative gain in massive profits is your loss- and in this case what you lose is your home.

The Big Data Players

At the center of the Landlord Tech universe are the big data players. These platforms collect and analyze so much data from sales and rental transactions that they are able to drive much of the transformation of the entire multi-trillion dollar real estate industry. These companies:

Operate as listing agents (listing properties for sale and representing home sellers);

Operate as agents for people looking to purchase homes as well;

Facilitate remote property transactions so the buyer never has to visit the property they're buying;

Can even provide temporary or permanent financing for the acquisition; and

They'll even help you find an apartment to rent.

The range of their services has become so broad, facilitated by access to and management of property transaction data, that they are able to gather ever increasing amounts of data. With every new transaction, they increase their data share and their profitability.

"These services aim to provide comprehensive data on local property markets on a national or international basis, and analyze markets with artificial intelligence, machine learning and big data," says Professor Desiree Fields of UC Berkeley in her 2017 essay.

Because these companies are so large and are engaged in so many aspects of the real estate business, a few have become widely familiar even to people who don't work in the real estate business. Some of these players include Redfin, Compass, RET Ventures, Kodit.io, Skyline AI, Reali, CoreLogic. Some of these big data players are even wedging their way into providing real estate financial services such as Flyhomes, ShelterZoom, ATLANT, ZeroDown, Landis, and Unison.

Even the multi-billion dollar gaming industry reinforces the culture of big data and speculation in the real estate industry by using real time pricing data for property sales and rents to create "big data" games such as "Landlord Tycoon", "Landlord Estates", "Greed City" and "Landlord Go". These games reinforce and glorify the culture of real estate speculation and profiteering. They also collect and manage vast amounts of marketable data about real estate trends and strategies.

Who's Getting Rich From Landlord Tech

Tech Platforms

Real estate as an industry has figured out ways to use its services to capture and analyze vast amounts of data in ways that other industries figured out years ago. Think about Google Maps or Gmail. Google is providing you with a valuable service- something that makes your life easier and more manageable. In exchange for providing you a service, you're giving Google valuable information about your life- your interests, where you go, what time of day you go there, etc. Google is then able to take that information and sell it- monetize it- in a variety of ways.

Landlord tech works in the same way. Sometimes the service seems like it's the most helpful new thing in your life! Like using a smart card instead of a key to get in your building. Like paying for a residential "membership" instead of a long term lease. Like having a company pay your security deposit or your rent for you- or select a roommate for you. Most of these probably don't even sound like they're "tech" companies at all. Not only are they tech companies, but they are enabling a vast network of speculation based on the data you provide. Not only will they take your privacy- they will also steal your home.

Some people may wonder whether tech firms are struggling due to the COVID crisis, especially short term rental Landlord Tech platforms like Airbnb. This may seem like a reasonable assessment until you discover evidence of what journalist Naomi Klein calls "Disaster Capitalism".

In May of this year, Airbnb was suffering revenue losses due to the slowdown in the global travel market. As a result, Airbnb laid off about a quarter of their staff which amounted to roughly 2,000 people. This would have seemed like dire news, and of course it was for those thousands of people who lost their jobs, but Airbnb is not just flush with cash that it had accumulated from before the pandemic, it was still raising massive amounts of money so they could keep on track with their Initial Public Offering (IPO). Just weeks before laying off thousands of workers, Airbnb brought in one billion dollars of "fresh capital" and then raised another billion dollars "in debt as it seeks to pad its balance sheet." To put this in perspective, retaining those 2,000 workers at $100,000 per year for an entire year would only have cost Airbnb $200 million or merely 10% of what they had just raised in "fresh capital" and "debt".

We think of tech companies like Airbnb as being money making machines, but the news about the tourism industry's decline and other economic sufferings due to the COVID pandemic makes many people associate that dire news with a decline in the influence of Landlord Tech. Venture capitalists, however, have placed their bets with this industry, and they are going to make sure that as the pandemic wanes and the economy starts to grow again, that the platforms they've invested in are poised to make even more money than before.

Large Corporations

Imagine that you need to buy a home or rent an apartment. You figure out your budget, and you head out to look at places. Finally, you find the place you want, so you express interest to the owner. They seem to like you, so you get excited that you might be moving in soon. Suddenly it's no longer available. Ok, so you move on and try again with a different place. That one gets snapped up too. Then it happens again. Could this be Landlord Tech at work?

Landlord Tech is not just collecting data about transactions, they're using that data to outbid you for that home or that apartment you wanted. These Landlord Tech companies might be "Real Estate investment Trusts" (REIT) like American Homes 4 Rent or Private Equity (PE) firms like Blackstone. Remember that the two most valuable commodities to control in today's global capital markets are data and housing. These REITs and Private Equity firms either control both or they use their exclusive access to data to leverage being able to buy housing.

Venture Capital, which is marketed as being the investment engine of innovation, is being deployed not just to help Landlord Tech develop new technologies, but is also used by these firms to purchase actual housing. There is no way that you as a person looking for an apartment to rent or a home to buy can compete with these firms that have this kind of access to both data and money.

Diving even deeper, we see the use of "cryptocurrency" like bitcoin and other blockchain enabled transactions. These intensive high technology tools facilitate buyers from anywhere in the world to purchase housing anywhere in the world. So, that corporate buyer who just muscled you out of your dream home using a platform like DocuWalk, Escrow Commons or ATLANT may not have even been a US based REIT. It may have been a corporation from another country tracking where property values are increasing. Once they've locked onto an opportunity, they will view the property remotely, and then use a blockchain service to make the purchase.

Since buying property usually involves hundreds of thousands or millions of dollars, remote transactions are increasingly relying on blockchain services to protect these transactions from data or dollars being stolen. To avoid currency exchange and other fees, these deals can also be consummated using cryptocurrencies such as bitcoin. These services even enable "fractional ownership of real estate" making changing the nature of real estate from being "an illiquid asset" to being liquid, increasing the pace of speculation and putting tenants at even greater risk.

This corporate buyer might be your new landlord. Beware their speculative motivations as they may soon evict you to move in a more lucrative Landlord Tech platform. Or they may just be the proud new owners of an asset that's easily traded - even more so if it's kept vacant.

As UC Berkeley Professor Desiree Fields writes, "Housing is a linchpin in financial capitalism: investing in real estate is a key means of both absorbing surplus capital on the hunt for yield, and of accumulating more capital. These tendencies are reinforced by cultural discourses and ideologies that frame housing primarily as a vehicle to build wealth. Real estate platforms are funded and developed by actors with a vested interest in enhancing the market value of housing (e.g. private equity funds, venture capitalists). As such, we can anticipate they will reinforce the role of housing in financial capitalism." Housing is not just shelter, it is now used to create capital for huge corporations and the deepest pocketed investors.

Private Equity

The goal of private equity firms is to take over businesses, cut expenses and increase revenues then, after a couple of years of evisceration, sell off the carcasses of what used to be viable businesses at a considerable profit. The assets they sell seem valuable because of the increased revenues over reduced expenses, but typically, the strategies they deploy leave the businesses starved of talent and stripped of any long term viability.

After the financial crisis of 2008, Blackstone and other private equity firms got into real estate, picking up failed landlord businesses for a bargain. Then they started doing what they do best– seeking ways of increasing profits and reducing expenses.

Underlying the scam of the 2008 Foreclosure Crisis was the Mortgage Backed Security, a financial instrument created by banks then traded on the financial marketplace that made speculators rich off the backs of homeowners struggling to make their monthly mortgage payments. Actress Margot Robbie famously explained this in the film, The Big Short. The Dodd-Frank Act made that particular scheme less attractive, and the wave of foreclosures made millions of homeowners into tenants. So, Blackstone pioneered a new scam called a Rent Backed Security. You guessed it, these are investment opportunities for rich people to get even richer off the rents we all pay. In March of 2019, the United Nations called out Blackstone "As one of the largest real estate private equity firms in the world" for "recent structural developments that the Blackstone Group L.P. helped to instigate whereby unprecedented amounts of global capital are being invested in housing as security for financial instruments and traded on global markets, which is having devastating consequences for people. We are referring to the 'financialization of housing' and the dominant role you [Blackstone] play in financial markets through residential real estate."

Never satisfied with today's way of making money, private equity firms are constantly looking for new ways to increase the revenue side of the equation. Their sinister genius found that shorter term uses are more lucrative than long term. The industry calls this "the arbitrage model". In the example described above, rather than renting out an apartment for $2,000 a month that same apartment could bring in $4,500 for the month if hired out to a platform that manages it for a short term, high turnover use.

A private equity firm will look at this difference in revenue and want the higher number, not the lower one. They will then demand that all the housing in their portfolio cash flow as much like a hotel room as possible. So, they look at various strategies for making more money. One such strategy could be to evict the barista who can only afford $1,500 a month, and move in a tech engineer who can pay $3,000 a month. This replaces a lower income, lower paying tenant with a higher income, higher paying long term tenant. Another strategy could be to evict the teacher who's only able to afford $2,000 a month, and move in a tech platform for short term rentals or corporate rentals that can pay $4,000 a month or more. Depending on the market and the timing of these decisions, the private equity firm may opt for either- it increases revenue and offloads expenses onto the tech firm that manages the constant turnover.

Once these strategies start to take hold, other landlords want to replicate the practices of private equity firms. As a result, the real estate industry starts to train landlords that traditional long term housing is the least lucrative way to run a landlord business. They then train landlords and developers to act more like the profitable private equity firms.

Both the private equity firm and the landlord that's trying to act like one depend on tech platforms to collect and manage the data that enables these predatory business practices. Those tech firms can't build or manage their technology without the other equally insidious side of Private Equity- called Venture Capital (VC).

Venture Capital

This is the industry that invests heavily in tech startups. It's a type of Private Equity- but it's more diverse and it tends to be focused on emerging technologies. Many Venture Capital companies are backed by "angel investors" - some of whom have are wealthy people who have become very famous for making lucrative investments. At times, angel investors may invest directly in a new business. Generally Venture Capital firms have particular expertise, and some, like SoftBank's Vision Fund and SV Angel are so large that they will invest in multiple industries including real estate. For an overview of the Venture Capital industry, check out this article on Investopedia.

Real Estate Investment Trusts (REIT)

Of the five different types of REITs, the one we're concerned about is called the "Housing REIT". A Housing REIT is a corporation that's traded on Wall Street, and pays dividends to its shareholders. The REIT's value depends on the income from the properties it owns and manages. The higher the income the better.

Landlords and Developers

This network of Private Equity, REITs and Venture Capital has enabled a whole new system for making money off housing that has nothing to do with actually providing housing. In fact, these schemes have become so effective at commanding profits that every developer and landlord is competing with this new profit making benchmark. The pressure is so intense that even new developments are claiming not to "pencil out" unless they are able to secure a significant number of these short term tech enabled uses. Existing landlords such as the largest private, for-profit landlord in San Francisco, Veritas, has taken to effectively turn over their units from being tenant occupied to being short term and corporate uses.

Recent Impacts on Tenants

We have already described many of the ways Landlord Tech is impacting tenants' lives and livelihoods, and based on the business practices being deployed, we have speculated about other impacts. The economic impacts of the COVID-19 pandemic are still taking shape and affecting so many sectors of the economy, including Landlord Tech. Just as in any sector, some businesses are able to adapt and thrive. Others take advantage of the new context and are able to launch with great profitability. Some, however, are not able to adapt their model and either struggle or fail.

As this article in the New York Times reports in September of 2020, Airbnb has been able to update its business model to succeed in ways that traditional hotels have struggled or failed to do. At the same time, this article clearly finds that Airbnb's listings depend on commercial rentals, not homesharing, and the overtaking of housing by commercial rentals is having a significant effect on communities in a number of cities around the world.

In October of 2020, the San Francisco Chronicle reported that co-living platforms PlaceMe and Bungalow are struggling with steep declines in revenue while HubHaus stopped paying for utilities; it stopped paying rent to landlords; and it has now turned over the tenants' leases to the landlords. These platforms' websites are still operational, seemingly taking new inquiries for tenants. Similarly Sonder, a growing Landlord Tech platform, reportedly sued a San Francisco landlord in July to get out of their lease on the units they were operating in that building. As SFiST reported, two weeks prior, Sonder had "just closed a Series E funding round of $170 million, boosting its valuation to $1.3 billion. This despite the hotel and hospitality industry in general being in dismal shape around the globe - and despite Sonder having to lay off or furlough a third of its staff back in March."

Solutions

This problem seems pretty overwhelming! So, what can we do about it? It may seem overwhelming to think about regulating internet based businesses, but there are things we can do, even locally in our own communities and with our local governments, to make a difference.

Let's take, for example, Airbnb and the regulation of "short term rental" platforms. Half a decade ago, Airbnb mounted such fierce and well-funded opposition to regulating short term rentals that it seemed impossible to legislate and enforce such regulations, but various cities took different courses of action ranging from limiting the number of short term rentals, or limiting the number of nights they can operate in particular units, to banning them altogether. It's an imperfect patchwork of regulations, but at least significant progress was made through tenant organizing and legislation.

The proliferation of these Landlord Tech platforms, and the scale of money invested in them has increased dramatically just in the past five years. Therefore, we have to match the scale of the problem with a new scale of thinking around our strategies for fighting back. Landlord Tech fundamentally challenges our concept of housing, how it's capitalized, and to what extent we're willing to assert our right to shelter. One action you can take today is to fill out the survey on the Anti-Eviction Mapping Project's website so we can all have as complete a picture of where these technologies are being deployed as possible.

[people. power. media], the Anti-Eviction Mapping Project and the AI Now Institute at NYU are hosting a space for tenants and tenant organizers to work together on solutions. If you want to participate, send an e-mail to joseph [at] peoplepowermedia [dot] org, and write "Landlord Tech Organizing Inquiry" in the "subject" line.